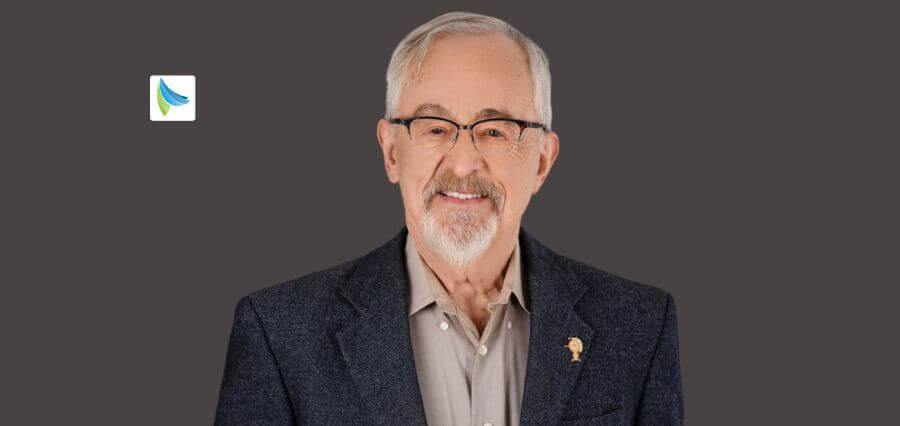

“Innovation is not about doing something new for the sake of it—it’s about solving real problems with purpose and empathy.” These words capture the essence of Sajja Praveen Chowdary’s leadership philosophy.

As the Director of PolicyBazaar for Business, Sajja is redefining how businesses across India perceive and adopt insurance solutions. Spearheading the Corporate and SME Insurance vertical, he is not only driving significant growth but also pioneering a culture of proactive risk advisory—empowering corporate India with intelligent, integrated, and preventive insurance solutions.

With a keen focus on customer-centric innovation, Sajja believes that understanding the ever-evolving needs of clients is the key to unlocking meaningful transformation in insurance. “If you listen closely to the customer,” he says, “innovation becomes inevitable.” This belief is deeply embedded in how PolicyBazaar for Business approaches digital risk, cyber security, and other complex organizational exposures—designing tailor-made solutions that go beyond coverage to actively help clients avoid incidents in the first place.

Sajja’s journey at PolicyBazaar for Business has been marked by dynamic impact—from scaling retail verticals like motor and term life insurance to now transforming the commercial insurance space. With over 15 years of experience across business, product, and technology management, he brings a rare blend of strategic thinking and hands-on execution.

Holding a B. Tech in Electronics & Communications and an MBA in Marketing from IMT Ghaziabad, Praveen’s passion lies in building brands from the ground up and creating lasting value through innovation.

In a sector that often plays catch-up with technology, Sajja Praveen Chowdary stands out as a visionary leader who is not just keeping up with change—but confidently shaping its future.

How? Let’s find out.

Sajja, as a visionary leader in the industry, could you take us back to the beginning of your journey? What motivated you to step into this dynamic ecosystem?

I began my career with brief stints at IPRU and Citibank before joining PolicyBazaar for Business, where I’ve now spent nearly 14 years. My early years at PolicyBazaar for Business were focused on establishing initial processes. I joined the Mumbai office to manage insurer relationships, as most insurers and banks were based there. Traveling frequently from Gurgaon for meetings was a challenge for the team, so I stepped in, along with a few others, to bridge the gap locally.

My primary responsibility was to understand the pain points of both insurers and our internal teams and to align solutions accordingly. This role, rooted in business development, gave me invaluable insights into how insurers viewed us and the value they expected.

Later, I moved to Gurgaon to lead tech and product partnerships with insurers, helping to build the digital ecosystem at a time when most insurer systems were geared toward agency models. Online business was nascent—just 0.5% of total business—so insurers were hesitant to prioritize it. We worked together to create dedicated digital solutions, which were vital for scaling our online operations.

Though I came from an engineering background, I had limited exposure to tech execution. This role deepened my understanding of architecture, backend systems, frontend interfaces, and project timelines—enabling me today to assess feasibility, resource allocation, and problem diagnoses effectively.

Following that, I handled strategic partnerships with e-commerce firms to drive traffic and explore collaborative opportunities. When that space didn’t yield the expected traction, I transitioned to head the vehicle insurance business. Over four years, we introduced industry-first services like self-video inspections and claims processing, which were later adopted by others in the market.

I then moved to lead the term insurance segment, co-creating innovative products with insurers based on real consumer feedback. For the past two and a half years, I’ve been heading the company’s corporate arm, PolicyBazaar for Business, continuing to innovate and lead from the front.

What were the key challenges and milestones you faced while scaling the company’s retail businesses before transitioning to the corporate insurance niche?

While leading the motor insurance business at PolicyBazaar for Business, one of the key challenges we faced was managing renewals for lapsed car insurance policies. Customers who missed their renewal deadlines were required to undergo vehicle inspections—a cumbersome and inefficient process at the time. There were no standardized digital solutions, internet bandwidth was limited, and coordination with multiple inspection agencies across states created significant operational chaos.

Each insurance company worked with different inspection vendors, leading to overlaps, inconsistent service quality, and data leakage. The inefficiencies affected conversion rates and customer experience. We realized this was not scalable and began exploring more streamlined, tech-driven alternatives. Engaging with our insurance partners, we asked a fundamental question: “How can we simplify and secure this process?”

Initially, we considered photo submissions from customers, but fraudulent submissions undermined the credibility of that approach in the past. That led us to explore self-video inspections. To address concerns about tampering, we developed an app that ensured secure, real-time video capture with verification layers to prevent manipulation. The result was a seamless, fraud-resistant, self-inspection tool that significantly improved customer experience and became a benchmark in the industry.

Another key challenge I observed—especially in retail segments like term life and health insurance—was customer hesitation. Even though they acknowledged the importance of insurance, many questioned the urgency: “Do I really need to buy this now?” Our focus shifted to educating customers about rising policy costs and age-related premium hikes. By showcasing historical trends and demonstrating how delaying purchases could impact affordability, we were able to drive home the need for timely action.

Whether it was streamlining inspection for motor insurance or breaking psychological barriers in life and health insurance, we consistently focused on consumer insights to develop meaningful solutions. That customer-first approach has been instrumental in driving both innovation and impact across our insurance offerings.

How did your experience in business management, product development, and marketing shape your leadership approach?

One of the most valuable experiences in my journey has been my stint on the tech and product side, which gave me a deeper understanding of how to envision the future as a leader. While I may not be directly executing every task, as a leader, it’s essential to have a clear grasp of what goes into delivering successful projects. In routine operations, delays may not feel critical. But during moments of crisis or high pressure, quick and informed decision-making becomes essential.

Understanding the nuances of technology and product development helps immensely in such situations. Whether it’s assessing how long a fix might take or evaluating the viability of a proposed solution, leaders must be able to make realistic judgments—not just rely on what they’re told. It allows for better optimization, smarter questioning, and, ultimately, more efficient operations.

This exposure has helped me lead with greater confidence and clarity. I can now identify when a team member is heading in the wrong direction due to a lack of experience and guide them accordingly. It also sharpens the ability to conduct thorough root cause analyses (RCAs), ensuring problems are truly addressed at their core. Overall, it has strengthened my ability to lead strategically while staying grounded in operational reality.

How is PolicyBazaar for Business addressing the unique Insurance needs of SMEs and large enterprises in India?

At PolicyBazaar for Business, we firmly believe that the foundation of any meaningful solution lies in deeply understanding the customer’s pain points—and this philosophy holds true across all segments, including SMEs and large enterprises. Over the past few years, we’ve consistently focused on listening to our clients—whether it’s corporate entities, SMEs, or the employees who are ultimately covered under these insurance plans.

For large enterprises, we’ve identified three primary focus areas. First, employee service and experience: Claims and hospitalization can be high-stress moments, and delays in assistance or information—often routed through HR or admin—can severely affect employee satisfaction. To address this, we’ve built streamlined, tech-enabled processes that ensure real-time support and seamless claims tracking.

Second, we address administrative challenges. Large organizations often struggle with reconciliations—such as monthly additions and deletions of employees, refunds, or CD balance adjustments. We’ve created robust dashboards and real-time reporting tools so HR and policy admins no longer need to rely on manual follow-ups. Everything is accessible, transparent, and audit-ready.

Third, we help companies manage their premiums better. Insurance premiums are often influenced by claim ratios, and we’ve developed analytical tools that help clients proactively monitor claims trends, optimize coverage, and make data-backed decisions throughout the policy year—instead of waiting until renewal.

From an SME perspective, the challenges are different. Historically, SMEs have had limited access to transparent insurance options. They’ve often relied on individual agents or small brokers without visibility into the broader market. This lack of transparency has led to a mismatch in pricing and inadequate coverage.

PolicyBazaar for Business has bridged this gap by building a digital-first platform specifically for SMEs. Much like our retail comparison model, this platform allows small businesses to compare insurers, plans, and pricing in real time—empowering them with choice, clarity, and control. These solutions are tailored, cost-effective, and easy to implement, which is especially important for businesses without large HR or admin teams.

Moreover, we recognize that SMEs evolve. As they grow into mid-sized companies, their insurance needs become more complex. Instead of switching providers at every stage, we position ourselves as a long-term partner, offering scalable solutions that evolve with the business. Whether it’s expanding coverage, customizing policies, or introducing new benefits—we support them throughout the journey.

Internally, we’ve structured our teams to reflect this diversity. We have dedicated specialists for large corporates and separate teams focused on SMEs, ensuring every client—regardless of size—receives the expertise and attention they need. Across both segments, our goal remains the same: deliver seamless service, customized solutions, and complete transparency.

In short, PolicyBazaar for Business is redefining how insurance is delivered to businesses in India—by combining technology, customer insight, and scalable solutions to serve both large enterprises and growing SMEs with equal effectiveness.

How is PolicyBazaar For Business leveraging technological advancements like AI to offer better insurance solutions to businesses?

At PolicyBazaar for Business, our core belief is that technology should be a means to solve real-world problems—not just innovation for the sake of it. Every tech intervention we make is driven by the intent to either enhance service delivery, reduce the turnaround time or eliminate friction from the user journey. And this principle extends to our approach to AI and other emerging technologies in the insurance space.

A great example is how we’ve improved the employee experience when it comes to group health insurance. Traditionally, employees would receive their e-cards and policy documents via email at the start of the year—but most wouldn’t remember or access them until a medical emergency struck. In such moments, employees would scramble to contact HR, who would then reach out to insurers or TPAs to retrieve the required documents—often causing delays and stress.

To address this, we built multiple tech-enabled access points for employees. Through our dedicated Employee Wellness App, employees can now access their e-cards, file claims, and track policy details in real time. For those less inclined to use mobile apps—such as blue-collar workers—we’ve also introduced a WhatsApp-based bot. With a simple “Hi,” users receive intuitive menu options including “Download E-card,” making support available 24×7 without relying on HR or admin intervention.

We’ve even considered scenarios where someone else, such as a colleague, may be assisting the insured individual. In such cases, our employer-side admin panel allows HR teams to instantly retrieve and share the e-card with just a click—eliminating the wait and confusion.

This is just one example of how we’re solving micro-level pain points through thoughtful tech design. Importantly, these solutions are inclusive and designed for accessibility—whether the user is in a corporate boardroom or on a factory floor.

As we scale further, we are actively integrating AI to drive smarter analytics, faster claims processing, and more personalized policy recommendations for businesses. The goal remains the same: to simplify insurance, empower decision-makers, and deliver seamless service across the board.

Technology, when applied with purpose, becomes a powerful enabler—and that’s exactly how we’re leveraging it at PolicyBazaar for Business for businesses of all sizes.

How do you see the corporate insurance landscape evolving in India over the next five years?

The corporate insurance landscape in India is poised for a significant transformation over the next five years, shaped by two key domains: employee benefits and commercial lines (covering assets, liabilities, and operational risks).

On the employee benefits side, there has been a sharp escalation in healthcare costs, particularly post-COVID-19, driven by medical inflation and evolving employee expectations. Many organizations—especially newer-age companies—are adopting generous benefits packages to attract and retain top talent. These include not just health insurance but also wellness-oriented add-ons like doctor consultations, OPD coverage, gym memberships, and annual health checkups.

However, this trend of extensive employee benefits may reach an inflection point. As costs continue to rise, companies will be compelled to assess sustainability. A balance must be struck between offering meaningful benefits and managing financial viability. Over time, we may see a more calibrated approach, where benefits are structured with smarter caps and better cost-control mechanisms to avoid misuse or inflationary pressure from the healthcare ecosystem. Organizations will also look more closely at how their offerings benchmark with the market, influencing both their retention strategy and budgeting decisions.

On the other side, technology and regulation will continue to reshape how corporate insurance is delivered and managed. The adoption of AI and self-service platforms is already streamlining administrative processes, reducing manual intervention, and making the experience more seamless for HR teams and employees alike. For instance, capabilities such as digital e-cards, automated claims filing, and real-time policy tracking have already enhanced efficiency.

Additionally, regulatory bodies are increasingly pushing for innovations like “cashless anywhere” frameworks, which will ensure more integrated experiences between insurers, TPAs, hospitals, and policyholders. As interoperability improves, the entire claim and service journey will become smoother and faster, minimizing friction across the ecosystem.

In essence, the future of corporate insurance in India will be defined by cost-conscious innovation, employee-centric wellness models, and digitally-driven efficiency. Organizations that can balance empathy with economics—while leveraging the best of tech—will lead the next wave of evolution in this space.

With the increasing cybersecurity threats, how is PolicyBazaar for Business helping businesses mitigate digital risk through insurance solutions?

At PolicyBazaar for Business, we approach digital risk as an essential part of the broader organizational risk landscape—which includes not just cyber threats, but also professional liabilities, asset protection, and operational exposures. Within this framework, our focus is not only on offering cyber insurance policies but also on building proactive solutions that help businesses prevent incidents in the first place.

In today’s evolving threat environment, it’s not enough to offer standard, one-size-fits-all insurance products. Many offerings in the market include coverages that sound extensive but may not be relevant to the specific risks a business faces. At PolicyBazaar for Business, we take a consultative approach—working closely with our clients to assess real risks, ensure the right coverage is in place, and avoid unnecessary inclusions that don’t offer real protection.

We’ve also built in-house digital tools and frameworks to help businesses, especially those with multiple offices or factories, monitor operational compliance in real-time. For example, rather than relying on manual checklists or outdated registers, our solutions track whether critical safety checks—like lift inspections or firefighting equipment maintenance—are actually completed and up to date. These tools can raise early alerts, helping businesses avoid incidents that might otherwise trigger claims.

On the cybersecurity front, our capabilities are strengthened by in-house experts with deep domain knowledge. We leverage their expertise to advise clients on practical cyber risk mitigation strategies, including how to strengthen their defense posture before an incident occurs. The goal is not just to ensure risk—but to prevent it.

While we ensure policies are well-structured and priced right, we recognize that no CISO or CTO wants to see their policy triggered. A breach means business disruption, reputational damage, and operational chaos. That’s why our core philosophy centers on prevention. Through technology integration, expert consulting, and collaborative engagement, we help businesses strengthen their digital resilience while staying covered—just in case.

As a leader, what are the key qualities you believe are essential for driving innovation in the insurance industry?

For us, at the core of PolicyBazaar for Business, the most essential quality to drive innovation is an unwavering focus on the customer. Innovation becomes truly meaningful only when it solves a real problem. It’s easy to chase flashy ideas or new technologies, but unless they address an actual customer pain point—whether in buying, onboarding, or claims—they won’t create a lasting impact.

A leader must cultivate deep listening and empathy. As customer demographics evolve—from Tier 1 to Tier 2 and Tier 3 cities—their needs, expectations, and challenges shift significantly. What worked for one segment may not apply to another. Innovation, therefore, must be dynamic and inclusive, keeping pace with these changes.

It’s also vital to embrace adaptability and data-driven curiosity. As we scale from thousands to millions of users, new insights emerge at every stage. These insights help us reimagine products, processes, and digital experiences, often in ways we hadn’t anticipated before.

At the heart of it, innovation in insurance isn’t just about technology—it’s about solving problems smarter and faster, with empathy and purpose. Leaders who consistently ask, “What is the customer struggling with?” and “How can we solve this better?” will always stay ahead of the curve.