Prime Highlights:

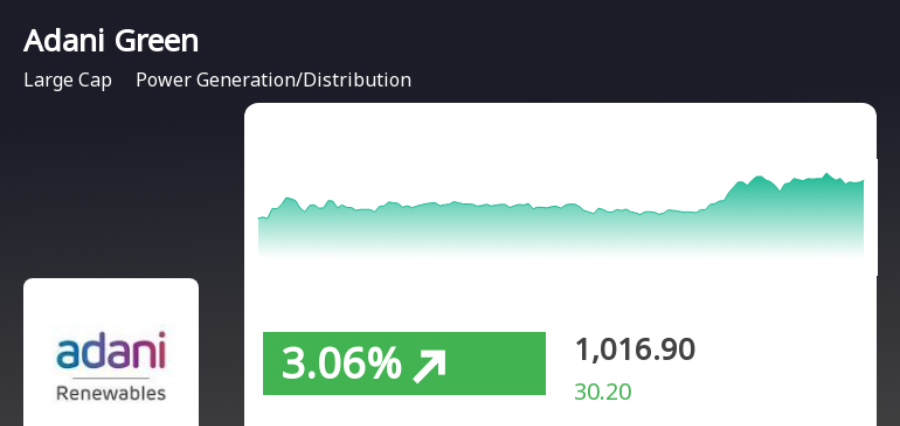

- Adani Green Energy rose 3.16% on May 27, surpassing its sector in conjunction with widespread market appreciation.

- The stock ended a two-day losing streak, hitting an intraday high of ₹1,020.

Key Facts:

- One-month return of the stock increased to 11.46%, outperforming the Sensex’s 3.82% return.

- Year-on-year, the stock has fallen 47.18%, lagging behind the Sensex’s 9.06% appreciation.

- Technically sound in the near term, the stock is above its 100-day but below its 200-day average.

Key Background :

Adani Green Energy Ltd. (AGEL) saw a strong rally in trading on May 27, recording a 3.16% spike in share price. This is a sharp turnabout from its two-day loss and indicates one of revival of investor interest. The share beat its sector by 2.37%, indicating enhanced sentiment in the backdrop of a largescale bullish market scenario.

The intraday peak touched ₹1,020 before closing a little below, reflecting robust buying strength during the day. This upmove also drove one-month return of AGEL to a remarkable 11.46%, much higher than the benchmark Sensex, which gained 3.82% over the same interval.

Although these are short-term positives, the stock is still way below where it was on a year-on-year basis. Adani Green shares have lost 47.18% in the last 12 months, a far cry from Sensex’s 9.06% appreciation. This decoupling is indicative of the volatility and investor fear factor in Adani Group stocks, which have been at the receiving end of regulatory action and market skepticism in recent months.

Technically speaking, the stock does seem to have picked up steam in the near term. It is trading over its 5-day, 20-day, 50-day, and 100-day moving averages. But it is still below its 200-day moving average, a longer-term measure that implies caution is still in order for long-horizon investors.

The overall market context has also supported the rally. The Sensex is still within 5% of its 52-week high, which indicates overall market strength and has lifted underperforming stocks like Adani Green. Sectoral optimism towards renewable energy and continuous government support for green infrastructure have also provided a degree of optimism.

Going forward, investors will be keeping a close eye on steady earnings performance, regulatory updates, and news on the firm’s project pipeline to ascertain whether this rebound has staying power. While short-term momentum is undeniably bullish, long-term recovery will depend on sustained operational and financial gains.

Read More: Developing Future-Ready Fleet Leaders: Coaching, Culture, and Capability